EC Launches Mid-Summer Consultation on Steel Safeguard Replacement

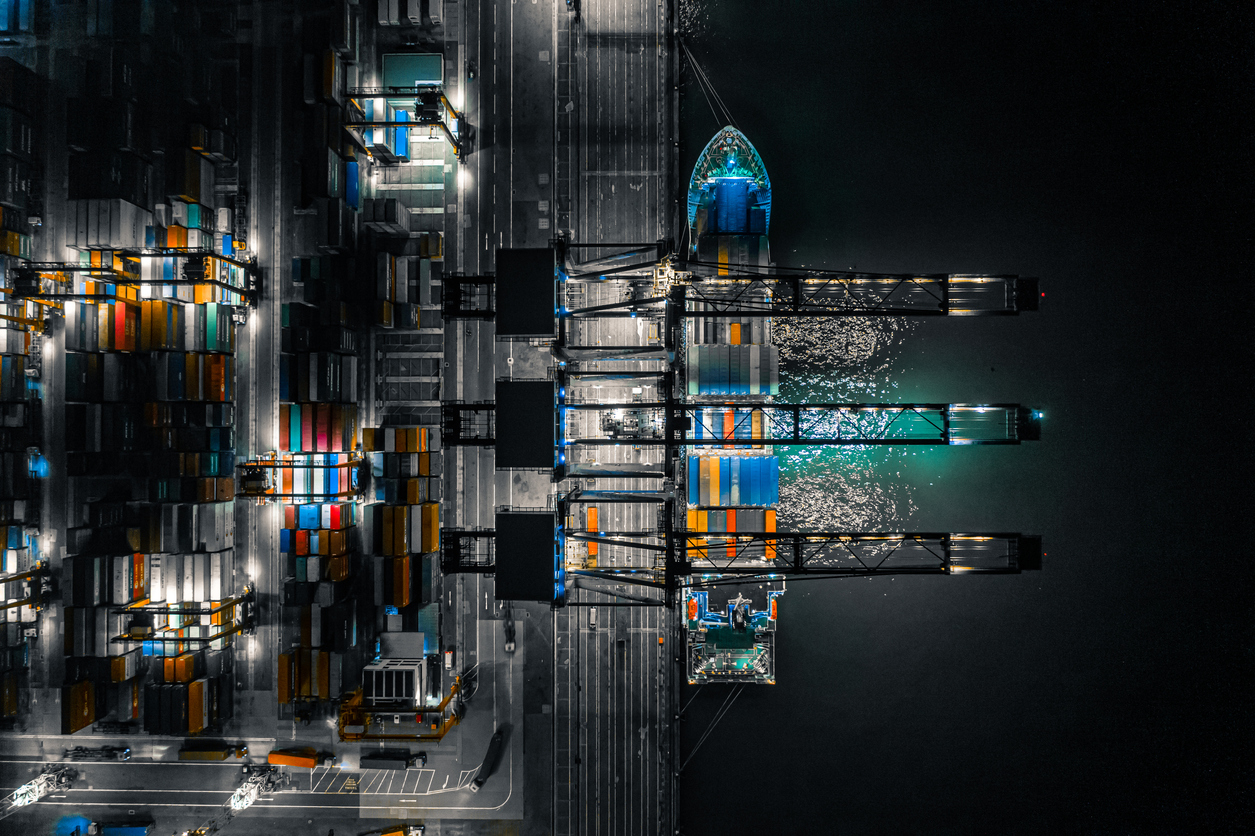

In March 2025, the European Commission announced in its Steel & Metals Action Plan that it would propose a new trade instrument to replace the safeguard measure on steel imports, which expires on 30 June 2026. True to its word, DG TRADE launched a public consultation on the possible replacement of the safeguard… on 18 July, with submissions due by 18 August. Hardly the best moment to ask hundreds of European SMEs for relevant feedback on such a complex matter.

Despite the timing, EURANIMI responded with a 30-page submission, setting out the concerns of mill-independent importers and distributors of stainless steel across Europe. Detailed, evidence-based, and grounded in the day-to-day realities of the stainless steel supply chain, our position is clear: quota lotteries must end.

Current Safeguard Inherently Flawed

Since 2018, imports of steel into the EU have been subject to a safeguard measure in the form of tariff-rate quotas (TRQs). While conceived as a temporary emergency measure, the regime has been extended several times and is now due to expire in 2026. As safeguard measures cannot exceed eight years under WTO rules, the EC is looking for a suitable alternative. From our perspective, preferably one less flawed.

Over the years, the safeguard has become a source of constant uncertainty for stainless steel distributors. Quotas for certain products are exhausted within hours, and even at the very opening of a new quota period importers face an unknown duty – anywhere between 0% and 25% – depending on how much the quota is overrun. To maximise their chances, importers often keep goods in bonded warehouses until the new quota opens, meaning that large volumes are then customs-cleared simultaneously. This quota overrun uncertainty is not a minor inconvenience: for traders operating on narrow margins, even an intermediate duty of 8–12% can turn a shipment from profit into a serious loss.

Instead of predictability, the safeguard has created a state of permanent uncertainty. Companies cannot plan imports, calculate costs, or guarantee supplies to downstream customers. To make matters worse, practices differ between Member States: some customs authorities allow importers to withdraw goods when quotas are exceeded, while others do not. The result is unequal treatment and distorted competition within the Single Market, rather than genuine protection of the EU market as a whole.

Stainless Steel: exceptionally well protected

Stainless steel represents just 3% of the European steel market, yet is subject to no less than ten separate anti-dumping and anti-subsidy measures. On top of this, the Carbon Border Adjustment Mechanism (CBAM) will impose a major cost on imports from 2026, especially on stainless steel produced through carbon-intensive routes such as Nickel Pig Iron (NPI). The combined effect of the existing trade defence measures and the forthcoming CBAM already acts as a powerful protective wall for EU stainless producers.

In other words, stainless steel is already one of the most protected segments of the market. Adding yet another layer in lieu of the current safeguard would be disproportionate — especially considering the impact of CBAM remains wildly unclear, with less than four months to go before its implementation.

End Quota Lotteries – targeted measures… or flat tariffs

Our key proposals are:

• No blanket measure covering all steel products: The EU should not replace one general measure with another but differentiate according to market realities.

• Act only where unfair competition is factually demonstrated: If a thorough product-by-product examination reveals genuine distortions, the Commission should intervene specifically on those products using the existing trade defence instruments, rather than resorting to a new horizontal trade barrier.

• If the Commission insists on a general instrument, simplicity is key: A flat tariff – applied only where strictly necessary – would be far less distortive than a quota system. TRQs create legal uncertainty and penalise SMEs that cannot afford playing the quota lottery.

• Recognise the specific case of stainless steel: With CBAM already in place and expected to hit stainless steel particularly hard, additional restrictions would only hurt European distributors and their SME customers without any benefit for climate or competition.

• Reject impracticable concepts: Proposals such as attributing origin by “melt and pour” are impossible to enforce in practice. Both importers and customs authorities know how easily mill certificates can be substituted or falsified in complex supply chains. Any suspicion that the declared liquid-steel origin is incorrect could expose importers to heavy penalties and lengthy, costly disputes with customs — with 27 national administrations likely to interpret such rules differently, further distorting competition within the EU.

Opportunity Lies Ahead for EU

The expiry of the safeguard in 2026 is a chance for the EU to refine its trade policy on steel. Protection of domestic producers cannot come at the cost of legal uncertainty, inflationary pressures, and supply disruption for hundreds of thousands of downstream SMEs. Burdening Europe’s manufacturing base with higher costs and reduced access to raw materials would only erode competitiveness at a time when global rivals are moving ahead.

For stainless steel in particular, piling safeguard restrictions on top of CBAM and existing trade-defence measures would amount to over-protection. What our members need are predictable, neutral and enforceable rules that ensure a level playing field – not more distortions, and certainly not a one-size-fits-all measure applied indiscriminately to all steel products.

EURANIMI will continue to engage constructively with the European institutions, providing evidence from the ground and speaking for the independent distributors who secure Europe’s supply of stainless steel. After all, we are not content with mere commentary: we act, engage, and provide policymakers with concrete solutions backed by real market evidence.

If your company shares these concerns, join us: together, our voice carries further.

Related Articles

Case Documents

Please log in as a member to consult all related case documents.