A Complex Chain of Interdependence

Steel and aluminium are not like bread; baked daily in small quantities and bought when needed from the nearest bakery or supermarket. The European market functions as a complex ecosystem: producers, industrial consumers, service centres, distributors, traders, and downstream SMEs, all depend on one another — and on supply chains that reach well beyond the Union’s borders.

Every actor has its role, yet their interests differ. When the system runs smoothly, materials flow. But under stress, the balance tips — and it is often the smaller players, and the SMEs they serve, who are left exposed.

Mills & Production Campaigns

Steel and aluminium are not made to order. Producers operate in campaigns, configuring equipment for a grade or thickness until volumes reach an economic threshold. Switching campaigns is costly and must follow production logic — for example, rolling progressively narrower strip widths to preserve the rolls.

This reality explains two things. First, lead times are often long — at times, very long. Second, EU mills prioritise higher-value products, such as specialty alloys or tailor-made grades, which justify the cost of switching campaigns.

Each mill’s range is also limited by its tools — the width of a rolling mill, the maximum thickness of a caster. To offer “one-stop-shop” portfolios, mills frequently complement their own production with material from other mills, often abroad.

Large Industrial Users: The Mills’ Favourites

Some customers are always at the front of the queue. Large industrial groups — in aeronautics, automotive, appliances and beyond — purchase substantial and predictable volumes, often under long-term contracts, and pay a premium for security of supply.

These companies are the mills’ strategic clients: high-volume, reliable, prestigious, and profitable. In times of tight supply, they are served first. Others must make do with what is left.

Integrated Distributors: Serving Two Masters

Many producers have integrated distribution arms. These mill-tied distributors occupy a dual position: they are expected to take up the volumes their parent mills produce — even excess output — while remaining profitable.

To serve customers efficiently and increase profitability, they sometimes buy from other sources, including foreign competitors, but loyalty to their owners limits how far they can go. In short, they sit between two chairs: bound to their group, yet constrained by the market.

Independent Distributors: Flexibility and Last Resort

Independent stockholders have no mill behind them, no guaranteed supply, no cushion against scarcity. They source from European mills when possible and, when necessary, from fellow distributors, service centres, traders, or imports from outside the EU. Their business model depends on stocking a wide range of grades and dimensions — sometimes niche specialities — and supplying thousands of SMEs quickly and reliably.

For mills, independents are both allies and rivals: distributors handle large volumes, albeit at low prices, but compete for the same orders from mid-sized users.

When demand is weak, independents can absorb and stock excess mill production. But when supply is tight, they are last in line. This forces them into contingency plans — “Plan B and Plan C” — often relying on imports to keep customers supplied. Distributors’ constant adaptability makes them essential to the system’s resilience.

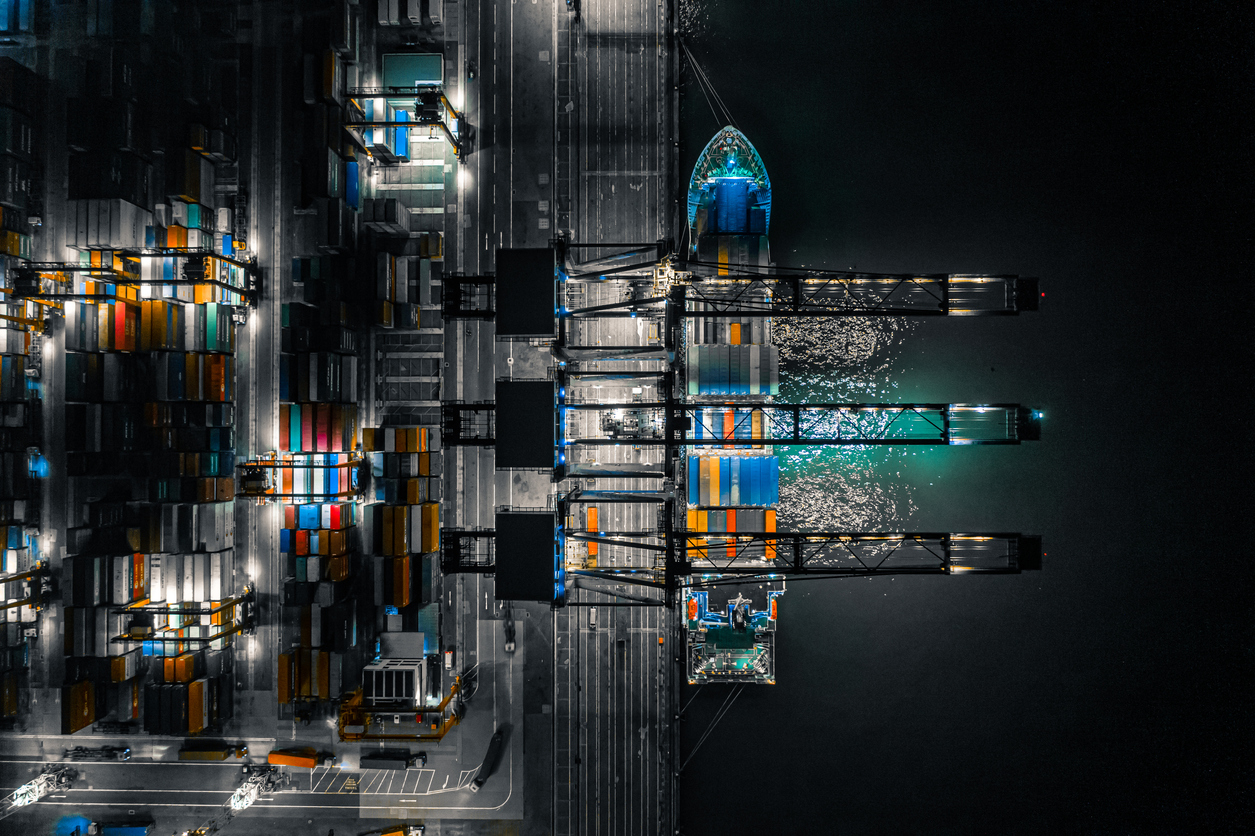

Traders: The High-Volume Connectors

Traders operate at scale, moving large volumes across continents, which makes them less suited to supplying small SMEs directly. They typically focus on larger consumers, service centres, or stockholders, often working without stock and buying material they have already pre-sold.

Sometimes they act as commission agents as well as resellers, working closely with their principals and ensuring transparency. Margins are narrow, but their role as connectors keeps the global market flowing.

Service Centres: The Workshops of the Value Chain

Whether independent or mill-tied, service centres start from coils — easier to ship and store — which they cut into usable forms such as sheets or strips. As coils are their feedstock, they can only source from mills or traders. They supply both distributors and industrial users, bridging the gap between large-scale production and specific end-use needs.

Downstream SMEs: Numerous, Vital, and Dependent

SMEs are the backbone of Europe’s economy. Collectively, they consume vast quantities of steel and aluminium. Individually, their orders are too small to interest mills, and they lack space to build up buffer stocks of input material.

This means they depend on distributors and service centres. Without these intermediaries, most SMEs could not access the material they need in the right dimensions and delivery schedules. This is a structural feature of the market.

A Fragile but Indispensable Balance

Every actor in this chain has a role. None is superfluous. Producers provide the raw material, large industrial consumers anchor demand, integrated distributors ensure group continuity, independents bring flexibility, traders connect global supply, service centres adapt products, and SMEs keep Europe’s economy dynamic.

But the balance is fragile. Whenever regulation, trade measures, or sudden shifts in demand distort the system, tensions appear: mills prioritise their favourites, independents scramble for alternatives, SMEs face scarcity, and traders fill the gap at higher cost.

The lesson is clear: without each link, the chain weakens. Steel and aluminium supply is not a question of ideology but of practical necessity. Imports are not distortions; they are part of the balance. Recognising this reality is essential for policymakers who want the EU’s manufacturing base to remain competitive and resilient.

Founded in 2021 as an international non-profit organisation, EURANIMI is the only association for independent importers and distributors that represents its members’ business interests at European level.

Find out more about what we do and why we do it.

Related Articles

Case Documents

Please log in as a member to consult all related case documents.