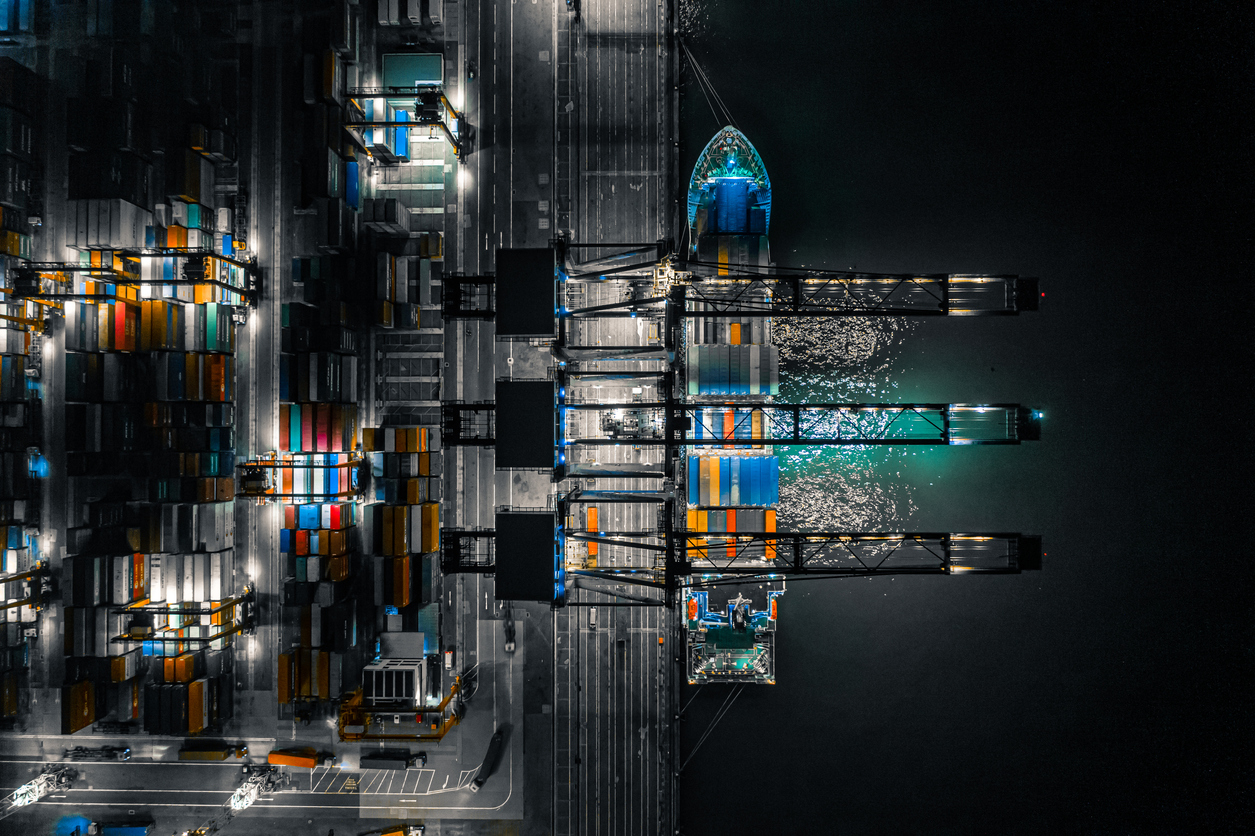

On September 24th, 2024, the European Commission announced its decision to register all imports of products subject to a defence investigation. Until now, the obligation for Member-State customs authorities to register imports upon initiation of a trade defence investigation was exclusively limited to circumvention investigations and could only be installed after 60 days from initiation.

This requirement has now been extended to include anti-dumping and anti-subsidy investigations and applies to future and ongoing investigations alike.

Increasing Uncertainty

Whilst the EC feels this will ‘simplify procedures and alleviate the burden placed on industry’, we are concerned that rather than combating unfair competition, it further undermines importers’ legal certainty with regards to duties payable.

The consequence of this new EC practice is that, from now on, as soon as a new anti-dumping and/or anti-subsidy investigation is initiated by the EC, all imports stand to be registered by Customs from one day to the next.

If, at the end of the 9-month investigation, the EC concludes that unfair trade practices have been found, all registered imports will be retroactively subjected to an anti-dumping and/or a countervailing duty.

With the rate of duty imposed not known until 9 months later, importers are left in an impossible position. They are never certain which duties will be payable, including orders already in progress: be it in order books, in production, or sailing.

60-Day Window

An investigation can be initiated at any time, yet where until recently AD/AS measures could only be installed after 60 days – giving importers time to clear ongoing orders through EU customs – this is no longer the case as all imports under investigation now risk being registered from day one.

The loss of this 60-day window might seem like small beer. Yet it is certain to impact every single one of our members who import stainless steel and/or aluminium to keep their 282 distribution, processing, or trading sites operational across 25 European countries, at one point or another.

Although the EC states that retroactive collection of duties is not automatic and is subject to certain conditions, this measure is nothing less than a death trap for European SMEs supplying EU manufacturers. However well-intentioned, the measure was designed to protect the interests of large production groups, not mill-independent SMEs.

Why EURANIMI

The steel industry is a global heavyweight in terms of protectionist measures, seeing an increase of 714% from 2008 to 2022. Over a quarter (26%) of EU trade defence investigations concern steel, with the vast majority (64 out of 67 as per January 2024) resulting in a protective measure.

The ever-increasing number of trade defence measures forces importing SMEs to acquire an ever-deeper command of customs law and leads to yet more contradictions between different regulations, resulting in growing legal uncertainty and unpredictability. A headache you can surely do without… legally and financially.

As EURANIMI, we call for a legal system in which clear rules are applied in a predictable manner. Join us as a member and add the weight of your voice to our call.

Related Articles

Case Documents

Please log in as a member to consult all related case documents.