On 21 February 2024, EU Member States agreed on the thirteenth sanction package against Russia, ahead of the second anniversary of the start of the Russian invasion of Ukraine. The aluminium sector had feared an import ban on raw aluminium, but thankfully this has not been the case says EURANIMI.

Status Today

The European aluminium sector is quite heavily dependent on Moscow based RUSAL as one of the largest aluminium producers in the world. If the EU were to impose sanctions specifically targeting unwrought aluminium from Russia, it would have a significant impact on the EU’s aluminium production and supply chain.

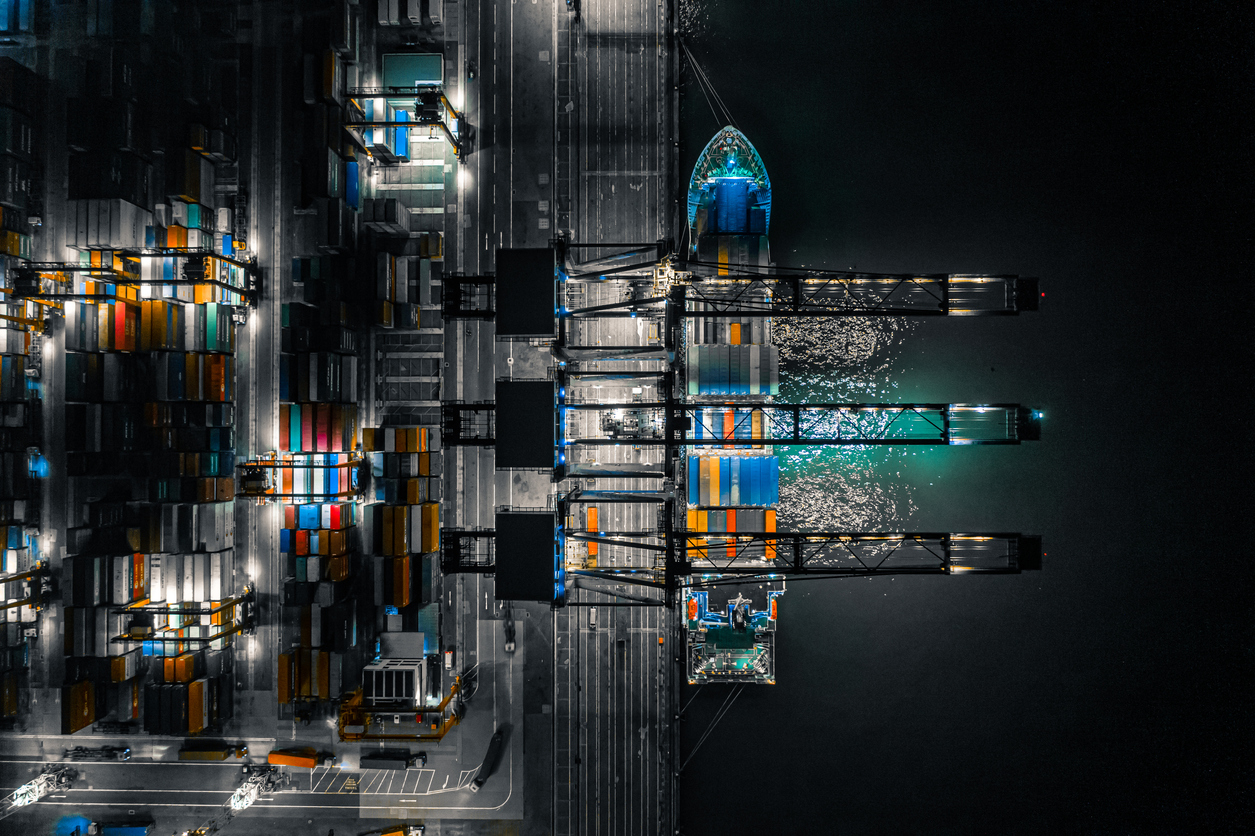

As it stands, members are already reporting increased warehousing premiums on aluminium of Russian origin, along with feeling the ongoing threat of a full ban by LME warehouses. To further compound matters, shipments from alternative markets such as Asia and the Indian subcontinent are suffering from conflict along the Suez Canal.

So what impact might a potential ban on Russian aluminium have on the European market? And what macroeconomic precursors are we seeing today?

Decreased Supply

Russia is one of the world’s largest producers of aluminium and a significant portion of its aluminium exports go to the EU. Although imposing sanctions on unwrought aluminium would directly hit Russia’s economy by reducing export revenue, it would also have a major impact on the EU by disrupting the supply chain.

The 2022 sanctions against Russian flat products and extruded products as of the end of 2023 have already stressed the market. Although much of this is currently balanced out by excess capacity in China and Europe due to lower usage on the aluminium consumer markets, once markets in Asia and Europe recover, we’re likely to see a shortage of raw aluminium and semifinished products moving forward.

Higher Costs

As shortages start prevailing, and with a decrease in the supply of Russian unwrought aluminium to the EU, prices are likely to increase even further. EU producers will have to source from other countries or find alternative supply chains, whilst manufacturers seek to fulfill their aluminium requirements. This increases production costs for industries reliant on aluminium, such as automotive, aerospace, and construction, and is certain to impact European competitiveness and profitability.

Alternative Suppliers

In response to further potential sanctions, both Russia and the EU may seek alternatives. Russia might look for new markets to export its aluminium, while the EU might increase imports from other aluminium-producing countries – such as Canada, Australia, or the Middle East – or choose to ramp up domestic production.

However, between disrupted vessel schedules and space tightening along two critical shipping routes, there are a number of macroeconomic indicators that are already disrupting supply chains. Unsurprisingly, almost every European producer has started looking for alternative suppliers of raw materials.

Domestic Production

To mitigate the impact of decreased imports from Russia, the EU might look to boost domestic production of aluminium. Although this would involve investing in and expanding domestic aluminium smelting capacity, it could provide more long-term stability to the EU’s aluminium supply chain.

A number of near-East companies have started to position themselves through the acquisition of European metal smelters in order to access the EU’s customer base. This underscores our belief that today’s precarious situation should be a warning to the European industry and capacities should be built up within our own sphere of influence.

Global Impact

Any significant disruption in the EU-Russian aluminium trade is likely to have repercussions on the global aluminium market. Other aluminium-producing countries may want to adjust their production levels or prices in response to changes in demand and supply dynamics.

As well as the threat of further possible sanctions against Russia, we must remain mindful of current affairs such as those related to the Suez Canal. Yemen-based Houthi militia have been targeting ocean vessels entering the Red Sea since early 2024, disrupting an already fragile global supply chain. From shipping delays to higher costs, potential sanctions need to be viewed from within a wider global context.

Trade Relations

Finally, sanctions on Russian aluminium could not only lead to broader trade disruptions, but further heighten geopolitical tensions. Diplomatic relations between the EU and Russia could become even more strained, with Russia retaliating with its own sanctions or other measures.

We are already seeing significant changes in the market – just as we did following the 2022 and 2023 sanctions against flat and extruded products from Russia – changes that for now do not look to be settling down any time soon.

Overall, EURANIMI believes the imposition of sanctions on Russian unwrought aluminium by the EU is likely to further disrupt the EU’s supply chain, leading to even higher costs, more supply shortages, and greater shifts in sourcing and production strategies for EU manufacturers.

At EURANIMI, we’ll be watching the market closely.

Related Articles

Case Documents

Please log in as a member to consult all related case documents.