The EU Regulation 2017/141 of 26 January 2017 – imposing definitive antidumping duties on the import of certain stainless steel tube and pipe buttwelding fittings – hardly constitutes recent news. A review due in 2022 (5 years after its introduction), was the ideal opportunity for EURANIMI to amplify its members’ message.

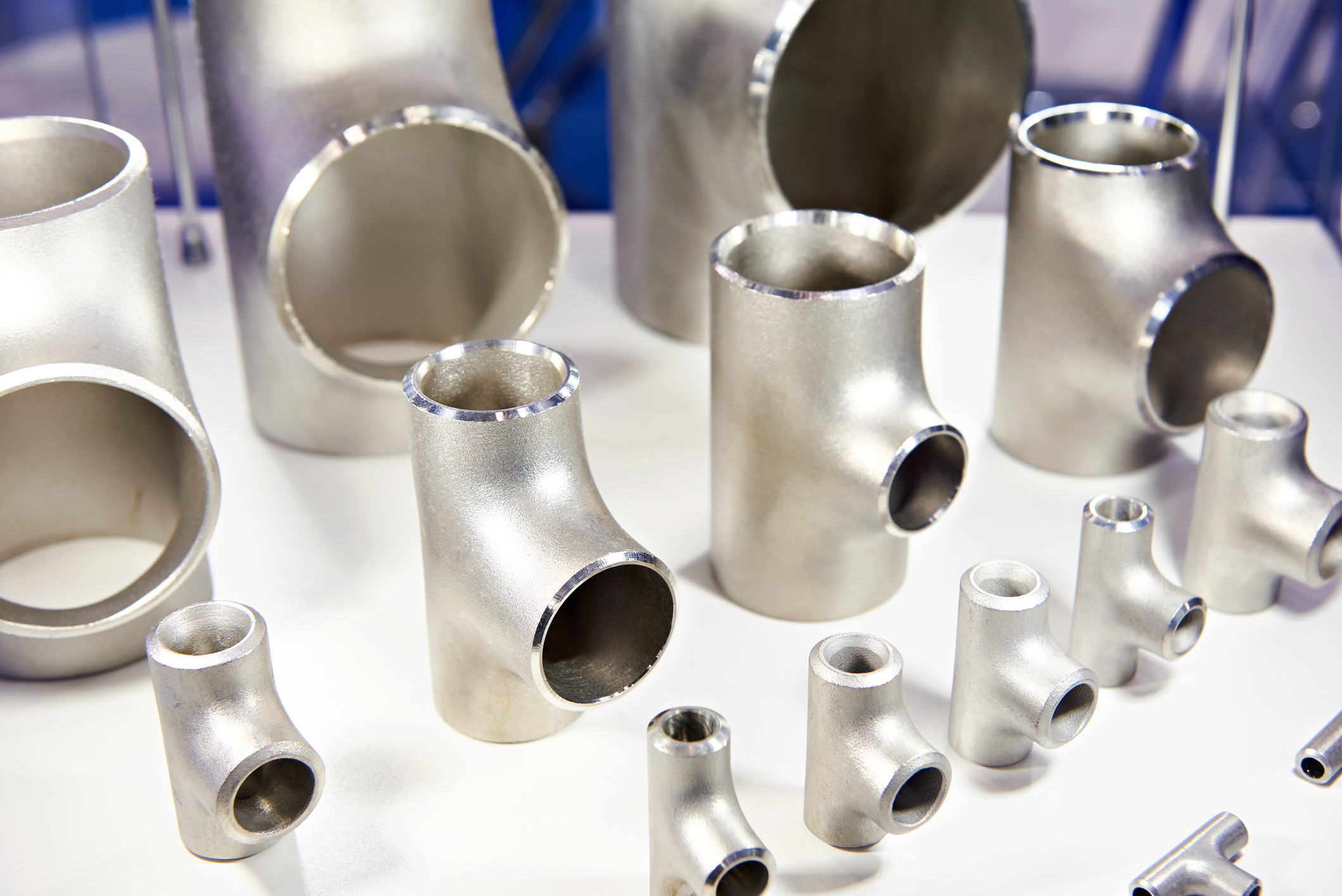

There are a number of ways in which this measure completely misses its target, explains Christophe Lagrange, Executive Board Member of EURANIMI. “First and foremost, it completely ignores the realities of the market. It doesn’t distinguish between products manufactured to European standards and those manufactured to American standards. The difference between both is comparable to that between a car destined for the UK market and the EU market. The difference may be minimal, the European market for right-hand-drive cars is virtually zero. It’s the place of application that determines the type used.”

US based clients (with or without European production sites) and multinational groups in Asia, the Middle-East or elsewhere, most often use fittings that meet US (ASTM/ANSI) standards. Although there is very little production of US standard fittings in the EU, they nevertheless represent a significant export market for European manufacturers.

“Secondly, by imposing anti-dumping duties up to 65% on imports from the main Chinese/Asian producers of fittings, the measure of 2017 encouraged circumvention,” adds Christophe. “Possible circumvention by actors in the market give rise to future anti-circumvention investigations. Such investigations cause a lot of misery and uncertainty in the market. Especially when, based on the conclusions of these circumvention investigations, the European Anti-fraud Office (OLAF) prompts the customs administrations of the EU Member States to retroactively collect import duties and impose fines that can go five years or more back in time. In such cases, no distinction is made between bona-fide imports and fraudulent practices.”

“Besides, 65% antidumping duty is an extravagant rate. Especially when it concerns ANSI/AISI products that are hardly produced in the EU. How can European manufacturers of assemblies compete with their competitors outside the EU, when the latter have access to products that they can buy at world market prices, without having to pay exorbitant customs duties?”

With the scheduled review of this measure taking place in 2022, EURANIMI drew the Commission’s attention to this aberration. Both in a hearing and in a later submission EURANIMI has exhorted the commission to reflect on better adapting this anti-dumping measure to the reality. Likewise, we invited the European Union’s fitting manufacturers to work towards a better solution, that would satisfy both the upstream and downstream sectors.

Our pragmatic invitation to discuss this anomaly among market experts was declined by the EU producers’ legal team and the EC chose to strictly stick to the object of the expiry review, estimating that no product exclusion could be examined in its framework. As a result, EU producers are shielded against ‘unfair’ competition, even in an area where there is hardly any local production.

EURANIMI’s hearing on 3 March 2022 had the effect of a self-fulfilling prophecy: 3 months later, on 7 June 2023, the EC initiated a circumvention investigation on imports of these fittings via Malaysia.

“EURANIMI’s members are aspiring to obtain a fair and self-explanatory rule for any market player to follow, thus avoiding retroactive and obscure measures which pose an evident distortion of the market competition practices.”

EURANIMI is considering applying for the initiation of a specific product review procedure in this context.